Welcome, reader! Have you ever wondered about the mysterious balance sheet in accounting? Well, wonder no more! In this article, we will break down the balance sheet in simple terms, so you can easily understand its importance and how to interpret it. Whether you’re a small business owner or just curious about financial statements, gaining a grasp on the balance sheet will be a valuable skill. Let’s dive in and demystify this crucial document together.

Understanding the Balance Sheet in Accounting

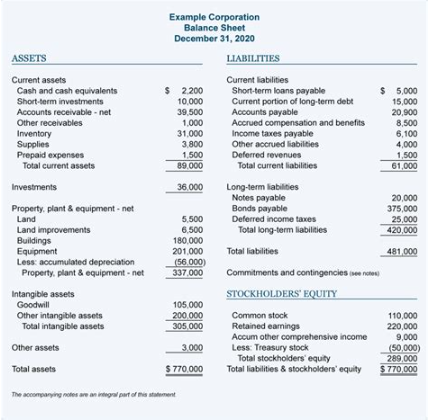

When it comes to understanding the balance sheet in accounting, it’s important to grasp the basics of what it actually is and how it functions within a business. The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It consists of three main components: assets, liabilities, and equity. Assets are what the company owns, liabilities are what it owes, and equity represents the owner’s stake in the business.

Assets are typically listed on the balance sheet in order of liquidity, meaning that the most liquid assets (such as cash and receivables) are listed first. These are followed by less liquid assets like property, plant, and equipment. Liabilities, on the other hand, are listed in order of when they are due, with short-term liabilities (such as accounts payable) coming before long-term liabilities (such as loans and mortgages).

Equity is calculated as the difference between a company’s assets and liabilities, and it represents the owners’ residual interest in the business. This is also known as shareholders’ equity in the case of a publicly traded company. Equity can be further broken down into retained earnings, which are the accumulated profits that have not been distributed to the owners, and additional paid-in capital, which represents the amount shareholders have invested in the business beyond the initial stock price.

One of the key purposes of the balance sheet is to provide stakeholders with a clear understanding of a company’s financial health and stability. By looking at the relationship between assets, liabilities, and equity, investors, creditors, and management can evaluate the company’s ability to meet its financial obligations, make strategic decisions, and assess its overall performance.

It’s important to note that the balance sheet is just one part of a company’s financial reporting. In conjunction with the income statement and cash flow statement, the balance sheet provides a comprehensive view of a company’s financial position and performance over a specific period of time. By analyzing these three financial statements together, stakeholders can gain valuable insights into a company’s profitability, liquidity, and solvency.

In conclusion, understanding the balance sheet in accounting is essential for anyone involved in the financial management of a business. By comprehending the key components of assets, liabilities, and equity, as well as their relationships to each other, stakeholders can make informed decisions about a company’s financial health and future prospects.

Components of a Balance Sheet

When it comes to accounting, the balance sheet is one of the most crucial financial statements. It provides a snapshot of a company’s financial position at a specific point in time, showing what the company owns (assets), owes (liabilities), and the shareholders’ equity. Let’s break down the components of a balance sheet:

1. Assets: Assets are the resources that a company owns and uses to generate revenue. They can be tangible, such as cash, inventory, and property, or intangible, such as patents and trademarks. Assets are typically listed in order of liquidity, with cash and cash equivalents at the top, followed by short-term assets like accounts receivable and inventory, and long-term assets like property and equipment.

2. Liabilities: Liabilities are the debts and obligations that a company owes to external parties, such as suppliers, lenders, and employees. They can be broken down into current liabilities, which are due within one year, and long-term liabilities, which are due after one year. Current liabilities include accounts payable, short-term loans, and accrued expenses, while long-term liabilities include bonds payable and mortgages.

3. Shareholders’ Equity: Shareholders’ equity represents the owners’ stake in the company’s assets after deducting its liabilities. It is calculated as the difference between total assets and total liabilities. Shareholders’ equity can be further divided into common stock, additional paid-in capital, retained earnings, and treasury stock. Common stock represents the amount invested by shareholders, while retained earnings represent the accumulated profits of the company.

4. Other Components: In addition to assets, liabilities, and shareholders’ equity, a balance sheet may also include other components such as accumulated other comprehensive income, which accounts for unrealized gains and losses on investments, and minority interests, which represent the portion of a subsidiary’s equity not owned by the parent company.

Overall, a balance sheet provides valuable insights into a company’s financial health and stability. It allows investors, creditors, and other stakeholders to assess the company’s ability to meet its obligations, its liquidity, and its overall financial performance. By understanding the components of a balance sheet and how they are interconnected, users can make informed decisions about investing in or lending to a company.

Importance of the Balance Sheet in Financial Reporting

When it comes to financial reporting, the balance sheet plays a crucial role in providing a snapshot of a company’s financial position at a specific point in time. It is one of the key financial statements alongside the income statement and cash flow statement. The balance sheet provides valuable information to various stakeholders, including investors, creditors, and management, enabling them to assess the financial health and stability of the business.

One of the primary reasons why the balance sheet is important in financial reporting is that it provides a comprehensive view of a company’s assets, liabilities, and equity. By listing all the assets that a company owns, such as cash, inventory, equipment, and investments, the balance sheet gives stakeholders insight into the resources available to the business. On the other hand, liabilities, including debts, accounts payable, and other financial obligations, are also detailed on the balance sheet, giving a clear picture of the company’s financial obligations.

Furthermore, the balance sheet also presents the shareholders’ equity, which is the difference between a company’s assets and liabilities. Shareholders’ equity represents the owners’ residual interest in the company’s assets after deducting all liabilities. It reflects the company’s net worth and can indicate the financial stability and long-term viability of the business.

Another significant aspect of the balance sheet is that it follows the accounting equation, which states that assets must equal liabilities plus shareholders’ equity. This fundamental principle ensures that the balance sheet is accurately prepared and provides a true representation of the company’s financial position. Any discrepancies in the balance sheet can indicate errors in financial reporting or potential issues that require further investigation.

Moreover, the balance sheet helps stakeholders analyze a company’s liquidity, solvency, and overall financial performance. By assessing the composition of assets and liabilities, investors and creditors can evaluate the company’s ability to meet its short-term and long-term financial obligations. Liquidity ratios, such as the current ratio, can be calculated using data from the balance sheet to assess the company’s ability to pay its debts on time. Similarly, solvency ratios, like the debt-to-equity ratio, provide insights into a company’s financial leverage and risk profile.

In conclusion, the balance sheet is a vital component of financial reporting that provides essential information about a company’s financial position and performance. It helps stakeholders make informed decisions, assess the company’s financial health, and evaluate its overall stability. By understanding the importance of the balance sheet, stakeholders can effectively analyze and interpret financial information to support their investment or credit decisions.

Analyzing a Company’s Financial Position through the Balance Sheet

When it comes to understanding a company’s financial position, one of the most important documents to look at is the balance sheet. This document provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. By analyzing the information presented in the balance sheet, investors, creditors, and other stakeholders can gain valuable insights into the financial health and performance of the company.

1. Understanding Assets:

Assets are the resources that a company owns and uses to generate revenue. They can include cash, accounts receivable, inventory, property, plant, and equipment, and investments. Analyzing the asset side of the balance sheet can help stakeholders understand the liquidity, efficiency, and profitability of the company. For example, a company with a high percentage of cash and short-term investments may be better positioned to meet its short-term obligations.

2. Evaluating Liabilities:

Liabilities represent the company’s obligations or debts that need to be paid off in the future. They can include accounts payable, long-term debt, and accrued expenses. By examining the liability side of the balance sheet, stakeholders can assess the company’s ability to meet its financial obligations and manage its debt levels. A high level of debt relative to equity may indicate increased financial risk for the company.

3. Analyzing Shareholders’ Equity:

Shareholders’ equity represents the amount of capital contributed by the company’s owners plus any retained earnings. It reflects the net worth of the company and can be used to assess the company’s overall financial health and stability. By comparing shareholders’ equity to total assets, stakeholders can determine the extent to which the company is financed by debt versus equity.

4. Examining Financial Ratios:

In addition to analyzing the individual components of the balance sheet, stakeholders can also calculate and examine various financial ratios to gain further insights into the company’s financial position. Some common ratios derived from the balance sheet include the debt-to-equity ratio, current ratio, and return on equity. These ratios can help stakeholders assess the company’s liquidity, solvency, and profitability.

By thoroughly analyzing a company’s balance sheet and considering the information presented in conjunction with other financial statements, stakeholders can make more informed decisions about investing in or doing business with the company. The balance sheet serves as a valuable tool for assessing the financial health and performance of a company and should be carefully reviewed and analyzed on a regular basis.

How to Interpret and Use Information from the Balance Sheet

When it comes to interpreting and using information from the balance sheet, there are a few key things to keep in mind. The balance sheet provides a snapshot of a company’s financial position at a specific point in time, typically at the end of a reporting period. It is made up of three main components: assets, liabilities, and shareholders’ equity.

Assets are what the company owns, such as cash, inventory, and property. Liabilities are what the company owes, such as loans and accounts payable. Shareholders’ equity represents the company’s net worth, calculated as assets minus liabilities.

One important aspect to consider when interpreting the balance sheet is the liquidity of the assets. Liquidity refers to how quickly an asset can be converted into cash without significantly affecting its value. For example, cash is the most liquid asset, while property may take longer to sell and convert into cash. It’s important to assess the mix of assets on the balance sheet to ensure the company has enough liquidity to meet its short-term obligations.

Another key element to look at is the debt levels of the company. By examining the liabilities section of the balance sheet, you can get a sense of how much debt the company has taken on to finance its operations. High levels of debt can be a red flag, as it may indicate that the company is taking on too much financial risk. On the other hand, if a company has a healthy balance of debt and equity, it may suggest that the company is well-managed and financially stable.

One important ratio to calculate when using information from the balance sheet is the debt-to-equity ratio. This ratio is calculated by dividing total liabilities by shareholders’ equity. A high debt-to-equity ratio may indicate that the company is relying too heavily on debt to finance its operations, while a low ratio may suggest that the company is not taking on enough financial leverage. It’s important to compare the debt-to-equity ratio to industry averages to get a sense of how the company’s financial position compares to its peers.

Finally, it’s crucial to look at the shareholders’ equity section of the balance sheet to assess the overall financial health of the company. If shareholders’ equity is increasing over time, it may indicate that the company is profitable and generating positive returns for its shareholders. Conversely, if shareholders’ equity is decreasing, it may indicate that the company is experiencing financial difficulties and may be at risk of insolvency.

In conclusion, the balance sheet is a valuable tool for investors, analysts, and stakeholders to assess a company’s financial position. By understanding how to interpret and use the information presented on the balance sheet, you can make more informed decisions about the company’s financial health and prospects for the future.

Originally posted 2025-03-11 18:00:00.